Using home equity to renovate

Need some cash to give your house the face lift it deserves? We explain how you can use your home equity to fund your renovation.

August 06, 2019 • 5 min read

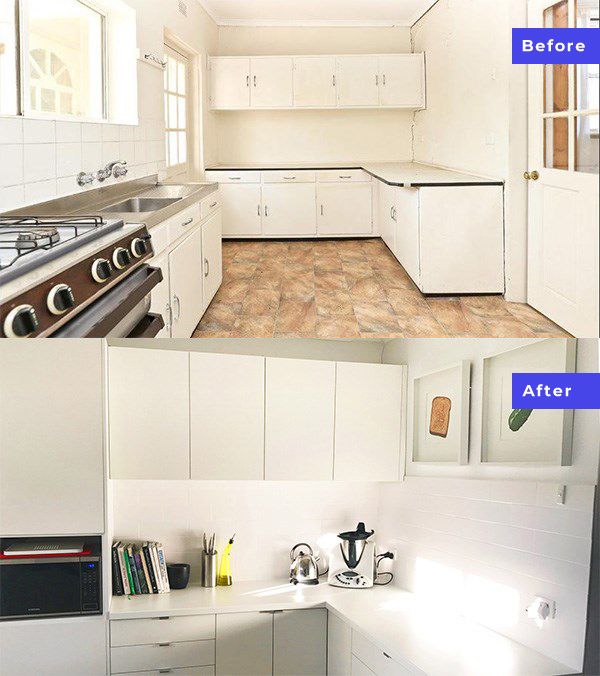

After buying your home, you’ve spent the last three years diligently paying off your loan. You’ve also been preparing your meals, patiently, from a kitchen designed in the 60's; never entirely sure if the splashback tiles are dirty or not because of their brown and orange hue. You’ve seen The Block and you now you want to flex your creative muscles and/or your wallet on a new interior design project.

Now is your time.

If your home has gone up in value, the amount of equity you have in the property will have gone up too. Equity is the difference between the money you owe on your home (what’s left on your home loan) and the value of your property.

The simple math

Property value – debt = equity

For example, if your home is worth $600,000, and you have $300,000 left on your home loan, your equity is $300,000. But that doesn’t mean you’ll be able to withdraw that $300K as easily as you’d withdraw cash from an ATM (side question: does anyone still use ATM’s?). It does mean, though, you can refinance your home loan to bump up your loan amount, which will give you some cash to spend on renovations.

How does it work?

Equity matters to you, and Loan to Value Ratio (LVR) matters to your lender. Your lender will typically want to make sure you have a maximum 80% (in some cases, 90%) LVR, which means they’re not lending you more than 80% of the value of your property. Now your property value has increased, your LVR has decreased.

When you originally bought the house for, say, $500,000, you had a $100,000 deposit ($400,000 loan amount) so your LVR was 80%.

Loan amount ($400K) as a % of property value ($500k) = 80% LVR

Now three years later, your home is worth $600,000. Plus, you’ve also paid a chunk of your home loan off in that time too. So now with only $300,000 owing, your LVR has dropped to 50%. That’s good.

Loan amount ($300K) as a % of property value ($600K) = 50% LVR

This means you can bump up your loan amount so that your LVR is back up to 80%, and you can use the ‘credit’ for your renovations. 80% of the value of your property is $480,000, so you will be able to borrow $180,000 more, and have that money available to you (so you can pay the people responsible for your kitchen makeover).

Loan amount ($480K) as a % of property value ($600K) = 80% LVR

So...

Maximum loan amount ($480K) – existing loan amount ($300K) = borrowable equity ($180K)

Using an offset account to store your released equity means you can reduce the amount of interest you pay, while still having easy access to your money when you need it. So once you have the $180,000 available to you, you can put it in your offset account so it’s there as you need it. And you won’t pay interest on that amount until you start making the withdrawals to pay your tiler.

How do I go about doing it?

The first thing to do would be to speak with your existing lender to discuss your options. They’ll value the property, work out how much borrowable equity can be released (the $180K) and do the sums to see whether you can afford to meet the higher loan repayments that will come from a bigger loan. You should certainly look at other home loan options too – this could be a chance to not only bump up your loan amount, but to get a better deal on your interest rate, too.

Then it’s time for the standard home loan application process: submitting documents, filling paperwork, and waiting. Unfortunately.

Unless you’re applying with Tiimely Own, in which case our 100% online application will assess you as you fill it out.

Quick tips and tools

- Work out how much equity you may have by getting a valuation done (your real estate agent will probably do this for you for free).

- Work out your maximum loan amount, which is typically 80% of the value of your property.

- The difference between what you currently owe, and your maximum loan amount, is how much you may be able to access for your renovation.

- Work out if you can afford a bigger loan, use a borrowing calculator.

- Head to Pinterest for kitchenspiration (warning: large chunks of time will be lost).

Learn more: